Business Insurance in and around Woodbury

Calling all small business owners of Woodbury!

Helping insure businesses can be the neighborly thing to do

Your Search For Fantastic Small Business Insurance Ends Now.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Dan Wright help you learn about great business insurance.

Calling all small business owners of Woodbury!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a dentist or a surveyor or you own a shoe store or a refreshment stand. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Dan Wright. Dan Wright is the person who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

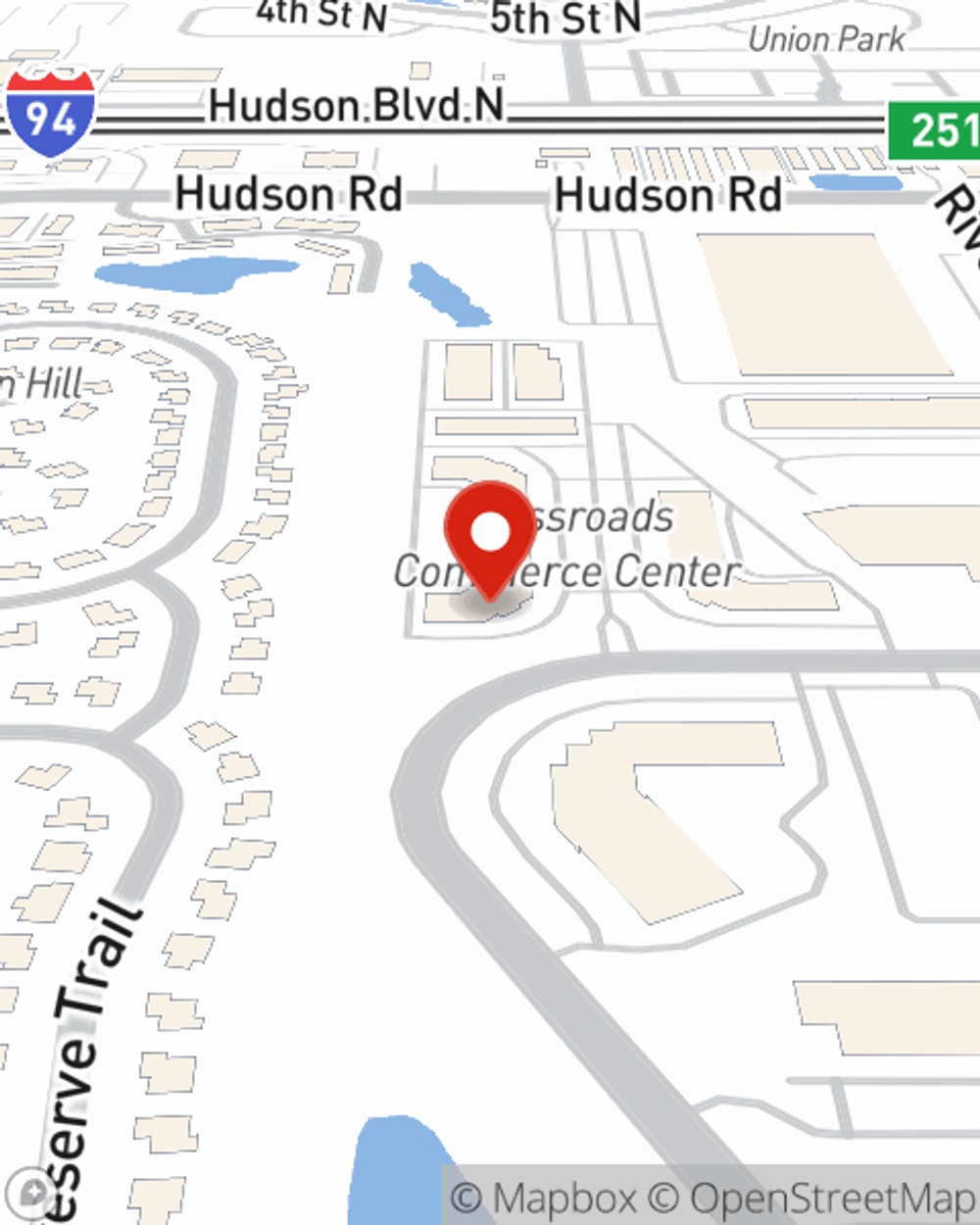

At State Farm agent Dan Wright's office, it's our business to help insure yours. Visit our wonderful team to get started today!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Dan Wright

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.